Lending Institution: A Smart Option for Financial Freedom

In a globe where financial choices can significantly affect one's future, the option of where to entrust your cash and monetary health is important. Cooperative credit union, with their one-of-a-kind member-focused method, use an engaging alternative to typical banks. By highlighting customized solutions, competitive rates, and a feeling of community, lending institution stick out as a smart selection for those looking for monetary flexibility. What establishes them apart from other monetary establishments? Stay tuned to reveal the distinctive advantages that credit report unions offer the table and exactly how they can pave the means towards a much more safe and secure economic future.

Advantages of Signing Up With a Lending Institution

When taking into consideration monetary institutions to join, people might locate that cooperative credit union use one-of-a-kind advantages that promote economic freedom. One considerable advantage of debt unions is their concentrate on participant satisfaction rather than exclusively on earnings. As member-owned organizations, cooperative credit union prioritize the needs of their members, frequently offering even more tailored solutions and a stronger feeling of neighborhood than traditional financial institutions.

Furthermore, lending institution commonly provide competitive interest rates on savings accounts and fundings. This can result in higher returns on savings and reduced borrowing expenses for members compared to bigger banks (Wyoming Credit). By providing these favorable rates, lending institution help their members achieve their financial objectives much more effectively

An additional advantage of cooperative credit union is their commitment to monetary education and learning. Lots of credit history unions supply workshops, seminars, and on-line sources to assist members improve their economic proficiency and make informed choices about their money. This concentrate on education encourages individuals to take control of their financial resources, inevitably bring about better monetary flexibility and security.

Reduced Costs and Better Rates

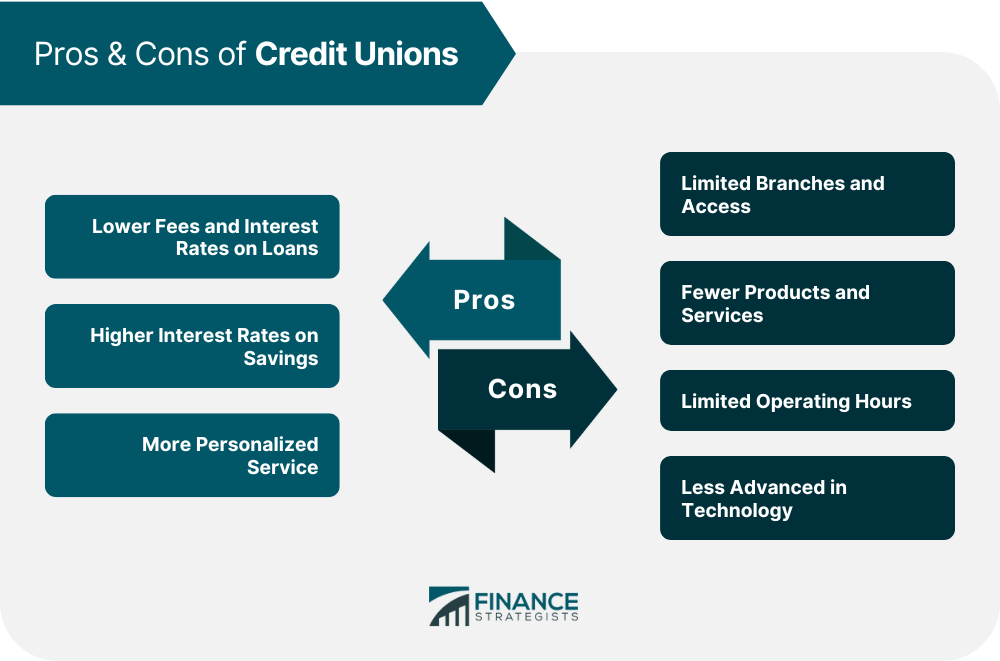

Signing up with a credit union can cause reduce charges and much better prices for participants seeking economic solutions. Cooperative credit union are not-for-profit companies that focus on offering their participants as opposed to making the most of earnings. This difference in framework usually equates to cost savings for participants. Credit history unions usually offer lower costs on services such as examining accounts, withdrawals, and overdraft accounts compared to conventional financial institutions. In addition, lending institution are recognized for supplying affordable rate of interest on cost savings accounts, loans, and bank card. By maintaining fees low and rates competitive, credit rating unions aim to assist their participants save money and achieve their economic goals more effectively.

When it concerns borrowing money, lending institution commonly supply extra desirable terms than banks. Participants might gain from reduced rates of interest on car loans for various objectives, consisting of auto lendings, mortgages, and personal fundings. These reduced rates can result in considerable long-lasting savings for debtors. By choosing a cooperative credit union for monetary services, people can make the most of these cost-saving benefits and improve their total monetary well-being.

Customized Customer Care

Cooperative credit union separate themselves from typical banks by providing personalized client service customized to the specific needs and choices of their members. This customized technique collections lending institution apart in the monetary market, as they prioritize developing strong connections with their participants. When you walk right into a cooperative credit union, you are greater than simply an account number; you are a valued participant of a community-focused institution.

One of the essential aspects of individualized client service at debt unions is the ability to talk directly with well-informed staff that are invested in aiding you accomplish your financial goals. Whether you are looking to open up a new account, use for a financing, or look for monetary suggestions, credit rating union reps are there to supply advice every action of the method.

Area Participation and Assistance

Stressing their commitment to local neighborhoods, cooperative credit union actively take part in area involvement and support campaigns to foster economic growth and financial literacy. By taking part in local events, funding area programs, and sustaining charitable companies, credit report unions demonstrate their commitment to the health of the areas they offer. These institutions commonly focus on collaborations with neighborhood services and companies to stimulate financial growth and produce chances for community members.

With monetary education workshops, lending institution equip individuals with the expertise and abilities required to make informed choices concerning their financial resources. Additionally, they offer sources such as budgeting tools, interest-bearing accounts, and affordable funding choices to assist community members accomplish their financial goals. By fostering a society of economic literacy and empowerment, cooperative credit union play a crucial duty in enhancing neighborhoods and promoting economic security.

Additionally, lending institution often team up with institutions, Wyoming Credit Unions non-profit companies, and government agencies to supply monetary education programs customized to particular neighborhood needs. This collaborative method guarantees that individuals of all backgrounds and ages have accessibility to the sources and assistance required to construct a protected financial future.

Financial Education And Learning and Resources

According to their dedication to neighborhood involvement and assistance, cooperative credit union focus on supplying economic education and learning and sources to encourage people in making enlightened economic decisions. By supplying workshops, workshops, on-line resources, and one-on-one therapy, cooperative credit union aim to boost their members' financial literacy and capabilities. These instructional initiatives cover a wide variety of topics, including budgeting, conserving, investing, debt monitoring, and debt payment approaches.

Financial education and learning equips individuals with the understanding and skills required to browse complex economic landscapes, leading to improved financial wellness and security. With accessibility to these resources, people can create sound finance behaviors, strategy for the future, and work towards achieving their economic goals.

Furthermore, cooperative credit union usually work together with neighborhood institutions, recreation center, and various other organizations to increase the reach of financial education programs. By engaging with diverse audiences and advertising economic proficiency at the grassroots level, credit scores unions play a pivotal role in fostering a financially educated and empowered society.

Conclusion

Finally, cooperative credit union use numerous benefits such as reduced charges, much better rates, personalized client service, neighborhood assistance, and economic education and learning - Wyoming Credit. By prioritizing participant fulfillment and monetary empowerment, credit history unions act as a clever choice for people seeking financial liberty and stability. Joining a debt union can assist individuals save money, achieve their economic objectives, and construct a strong financial future

When considering financial organizations to join, individuals may discover that credit scores unions provide distinct benefits that advertise monetary liberty. By selecting a credit rating union for monetary services, individuals can take advantage of these cost-saving advantages and enhance their general economic health.

In line with their dedication to community participation and assistance, credit rating unions focus on giving economic education and resources to empower people in making informed financial decisions. By prioritizing participant satisfaction and economic empowerment, credit unions offer as a wise choice for people seeking economic flexibility and stability. Signing up with a credit score union can aid individuals save cash, achieve their financial objectives, and build a strong economic future.

Comments on “Wyoming Credit Unions: Discover the Perfect Financial Companion Near You”